|

|

Australian

section

Milstern

Health Care

Retirement Villages - Urimbirra

and Lindfield Manor

Nursing Homes

- Ritz

and Yagoona

|

|

CONTENTS

Introduction

It has been suggested that this web page is

defamatory. I believe that this is because the page has been read out

of context instead of as part of a web site in which arguments and

context are created. Clearly it would be excessively tedious for the

reader and needlessly repetitive if I repeated all of the arguments

on every web page. There are over 400 of them. I have therefore now

written out a summary of these arguments. I am including a link to

that introductory page on new and on older pages as I update them.

Readers who come to the web pages for the

first time should consult that page. It will open in another window.

IF YOU HAVE NOT YET READ THAT PAGE YOU

SHOULD CONSIDER IT TO BE PART OF THIS PAGE AND ITS

INTRODUCTION.

Readers should consider it as an integral

part of this and other pages. This should remove any doubts as to the

intention of the web pages and their content.

Click

Here to go to the

introductory web page

The complaint about this web page was not

specific:- No reason was given for the claim that this page was

defamatory. To resolve the issue I have removed any comment of mine

that might be considered judgemental lest it is what gave offence. I

also apologise if the page gave the impression that it was the owner

of the company rather than the marketplace health and aged care

system which she and her company represent that I was criticising. To

address this issue I have now included material about the owners

retirement villages and other business operations in the wider

marketplace in order to place aged care into this very different

context.

I leave the reader to decide whether this

sort of environment is an appropriate one for health and aged care

and whether people who succeed in one can legitimately (and I don't

mean legally) bring the same patterns of thinking into health and

aged care - and whether this in fact happened. I argue that the

market and health/aged care are

essentially incompatible (pdf

file).

The selection of material to quote:-

Because the allegations made in the press reports were based on

assessments made by statutory bodies protecting citizens and on

allegations raised in parliament where there is a responsibility to

be fair I did not include all denials and other statements made by

the company and its staff in my original page. My comments were based

on the probability that there was substance to at least some of the

material.

It may be that the material was considered to

be defamatory because of a biased selection. I have therefore

reviewed all the material to ensure that the extracts are

representative and have included more statements made by the company

and its representatives. I have done the same for the new sections on

Retirement Villages and on the owner's hotel businesses. As a

consequence I have quoted from much more of this copyright material

than I normally do as fair use.

I repeat here that one thesis of this web

site is that likeable and charismatic people can be very successful

in the marketplace where they may perform well for themselves and for

society. I argue that these same people may perform poorly as

providers of health or aged care when that care is provided in a

marketplace context and is then evaluated in humanitarian terms. This

is because the two contexts are incompatible and those who succeed do

so by ignoring this incompatibility.

A good example of this is Peter

Smedley and his role in Mayne Health.

In the marketplace he was a hero but the application of his market

thinking to health care was Mayne Health's undoing. I have therefore

looked at the owner of Milstern's other successful business

operations. I have included some material to illustrate that

environment and the way success is achieved there. There are problems

when operating in such very different sectors and I recognise the

dilemma faced by those who try to do so.

The material is included for the reader to

assess and make up his or her mind. I would welcome a response from

Milstern and its owners in regard to this material and the selection

of representative extracts. I ask them to put their perspective and

respond to the concerns raised. This would be very

valuable.

Clearly I am on one side of the

divide in

perceptions that I describe on

another page on this web site. The arguments and assertions made are

intended to stimulate debate. This site lacks input from the other

side of the divide.

I am not in a position to clearly present the

position and arguments of those on the other side as I am critical of

them. I encourage Milstern to respond to the arguments on the web

site. They are summarised in the link at the top of this page. I will

include any comments they wish to make.

to

contents

The Milstern

Story

Milstern was a nursing home and retirement

village operator founded in 1986.

Mrs Millie Phillips a self made businesswoman

had made her fortune in mining. In the 1960s she developed an

interest in nursing homes and retirement villages. She formed

Milstern to acquire her health and aged care businesses and floated

it on the share market. She became involved in the marketing of a

diverse selection of products developed by an Israel

researcher.

Mrs Millie Phillips, a

survivor of the 1970s nickel boom, has again embarked on a public

course with the proposed listing of Milstern Health Care Ltd which

will seek 14 million $1 shares. At the launch of the prospectus

yesterday, Mrs Phillips, the chairman, said she will take a "huge

slice" of the float with Milstern Enterprises Pty Ltd, which she

controls, taking 2.5 million shares as consideration.

------------------------

Capital raised will be used to purchase, for $7.35 million, all

nursing homes operated by the Milstern group; partly finance and

purchase the land for the construction of a $6 million retirement

village in the Hills district in Sydney; and provide working

capital for the marketing and distribution of Omiderm - a

semi-permeable dressing for wounds.

Apart from property interests,

which include four nursing homes and three retirement villages,

Milstern has purchased the rights to four medical products and

other diagnostic tools used to detect bovine mastitis and

antibiotics in milk.

--------------------------

Mrs Phillips founded the nursing home and retirement villages

company in 1960 but is better known to the public for her

long-standing association with the nickel exploration company

International Mining Corp NL, of which she is chairman.

'Nickel Queen' On The Listing Trail Australian Financial

Review December 3, 1986

After 10 years out of the

limelight, housewife-cum-mining promoter Mrs Millie Phillips has

re-emerged with a new company - this time a health care concern

which is to raise $14 million from the public.

She hopes Milstern Health Care

Ltd, the new retirement village and nursing home concern, will

prove more profitable than her International Mining Corporation

NL, which for the past five years has turned in consistent

losses

The diminutive, Polish-born Mrs

Phillips, whose net worth is said to be about $40 million, says

she feels confident. Along with her mining activities, Mrs

Phillips has "been in the health care business" for 20 years or

so. And, she says, like IMC, she will "stick by the company until

it makes money".

Australia's richest self-made

woman earlier this year opened Rose Bay Towers as serviced

retirement apartments - which ultimately will also be sold into

Milstern along with other properties held by interests associated

with Mrs Phillips, including The Ritz Nursing home at Leura.

------------------------------

To show she means business, Mrs Phillips will put up $4 million to

take 4 million shares in Milstern, with a further 2.5 million

shares allotted to her as consideration for medical products

including Omiderm, the skin dressing developed in Israel for which

a company controlled by Mrs Phillips has the exclusive

Australasian agency.

Ultimately, she will emerge with

about 39 per cent of the company.

MINER MILLIE EXPANDS IN HEALTH CARE Sydney Morning Herald

December 3, 1986

Milstern Health Care Ltd

had a lacklustre day, but its $1 shares did open at $1.05 before

falling to $1.02 at close.

FINANCIERS KIND TO STAGS Sydney Morning Herald February 13,

1987

|

Mar 1987 Millie

Phillips and Professor Citri

|

However Mrs Phillips

projects the bulk of Milstern Health Care's profits will come from

the exploitation of the world-wide rights from research conducted

by Professor Nathan Citri, a microbiologist from the Hebrew

University of Jerusalem.

At least 10 per cent of the

profits from nursing home operations will be ploughed back into

the marketing of the health care products and the testing kits

developed by Professor Citri.

----------------------------

Apart from the purchase of nursing homes and retirement villages

and construction of an addition retirement complex, the capital

raised from the listing and the some of the operating revenue from

the retirement homes will go to developing and marketing test kits

and wound dressings which Mrs Phillips hopes will be the company's

major source of revenue by the 1988-89 financial year.

------------------------

Since the prospectus was issued Milstern Health Care has signed an

agreement with the CSIRO for contract research into the use of the

Citri reagent in a field kit to detect bovine

brucellosis.

An agreement has also been

reached with the NSW Dairy Corp to undertake development work,

laboratory and field trials for another Citri product which tests

antibiotic residue in milk.

---------------------------

The prospectus estimates profit for the first six months as a

listed company will be $448,000 with net profit in the year to

June 1988 of $1.99 million.

---------------------------

As the architect of the new venture Mrs Philips confesses that she

also does not fully understand the finer technical points of

research despite the fact she has backed Professor Citri's work

for the past few years.

However Mrs Philips remains very

confident that her new venture will be a big success.

Millie Phillips Takes A Healthy Look At Profits Australian

Financial Review March 3, 1987

|

May 1987 A new Citri

test for AIDS

|

The research aims to

develop a new detector of the AIDS virus invented by Professor

Nathan Citri of the Hebrew University of Jerusalem.

Milstern has funded Professor

Citri's research for the past 18 months and holds the world rights

to the Citri patents and potential franchises for pharmaceuticals

companies that would later market the device.

MILSTERN TO DEVELOP AIDS KIT Sydney Morning Herald May 28,

1987

Milstern Health Care Ltd

will fund the development of its new AIDS test in conjunction with

St Vincent's Hospital in Sydney. This development has the

potential to put AIDS testing kits in pharmacies.

Yesterday's announcement

explains the huge increase in Milstern's share price.

--------------------------

Milstern's resident medical specialist, Dr M. Garvan, said

yesterday that if the test kits did not reach the stage where they

were on sale to the public it would be for political rather than

practical reasons.

Milstern Will Fund AIDS Diagnostic Kit Australian Financial

Review May 28, 1987

to

contents

Takeovers, share sales and delisting from

stock market:- There was no more mention of the Israeli professor

and his many research inventions. In 1988 Milstern wrote off a large

sum and was taken over at 65c a share by Namark of which Mrs Phillips

son was managing director. Following this Mrs Pillips owned 92.2

percent of Milstern. To keep the company listed she sold some of her

shares.

The company suffered during the market

collapse of the 1980s and came into dispute with the Commonwealth,

about fees. In 1993 the companies shares were suspended and it was

then delisted. Information about the company became scanty for some

years.

|

Oct 1987 Not meeting

projections

|

Milstern Health Care Ltd posted a maiden net profit of $278,000,

which was below the projections made in the company's

prospectus.

However, the group's operations

started two months later than anticipated, and the results took

into account only five months of trading.

MILSTERN MAIDEN RESULT Australian Financial Review October

1, 1987

|

Sep 1988 A loss and

write off of research

|

In its second full year of operation, Milstern Health Care Ltd

has posted a 42 per cent increase in pre-tax profit to $725,000,

on turnover of $16.32 million.

----------------------------

However, Milstern suffered extraordinary losses of $3.5 million,

taking the company's total consolidating operating loss to $3.22

million.

In accordance with a decision

made in the first half of the year, Milstern wrote off all

capitalised research, distribution and prospectus costs as

extraordinary items.

MILSTERN EARNS MORE BUT OMITS DIVIDEND Australian Financial

Review September 8, 1988

|

Sep 1988 Takeover by

a family company.

|

Unlisted Mamark Holdings Pty Ltd has increased its offer for

nursing home and retirement village developer Milstern Health Care

Ltd to 65 a share.

--------------------------

The managing director of Mamark, Mr Robert Phillips, said that the

revised offer, which values Milstern at about $10.75 million, was

more than fair, considering the rapid increase in Milstern's share

price.

----------------------------

Mamark has already taken control of Milstern with 48.9 per cent of

issued capital.

MAMARK LIFTS ITS OFFER FOR MILSTERN TO 65 A SHARE

Australian Financial Review September 1988

|

Apr 1989 What is

this relationship?

|

Millie Phillips has sold down her commanding shareholding of

Milstern Health Care Ltd in an effort to keep the nursing home and

retirement village development company listed.

Yesterday Milstern Enterprises

Pty Ltd announced that it had reduced its stake in Milstern,

floated by Mrs Phillips in 1986, from 92.2 per cent to about 89.12

per cent by selling 2.5 million shares for 65c each or about $1.6

million.

Mrs Phillips' son and Milstern's

managing director, Mr Robert Phillips, yesterday said that the

private company had sold down its stake to keep Milstern Health

listed, and would continue to sell to reduce the stake to 85 per

cent.

-----------------------------

The extra shares now held by Milstern Enterprises appear to have

been gained through a takeover bid of 65c a share made last year

by Manmark Holdings Pty Ltd.

PHILLIPS REDUCES HER MILSTERN HEALTH CARE STAKE Australian

Financial Review August 11, 1989

Milstern's nursing home and retirement villages have been

operating satisfactorily. It benefited from the buoyant Sydney

residential market and settled a number of fee disputes with the

Commonwealth during the year.

MILSTERN UP BUT SHORT OF FORECAST Australian Financial

Review August 31, 1989

|

Apr 1990 Downturn of

late 1980s

|

Millie Phillips' Milstern Health Care Ltd has been affected by

the poor residential property market and high interest rates, with

its pre-tax profit falling to just $62,000 for the half to

December 31.

That almost break-even result,

recorded on sales which fell by 7 per cent to $16.2 million,

compares poorly with the $1.2 million pre-tax profit reported for

the previous corresponding half.

PROPERTY PROBLEMS AFFECT MILSTERN Australian Financial

Review April 3, 1990

A substantial drop in interest charges has helped Mrs Millie

Phillips'Milstern Health Care Ltd report an improved pre-tax

profit for the six months to December 1990, up from $64,000 to

$568,000.

INTEREST CUT BOOST FOR MILSTERN Australian Financial Review

February 13, 1991

|

Aug 1993 Removed

from stock exchange

|

"The above company whose securities are already suspended have

not paid their Annual Listing Fees for the year commencing 1 July

1993."

MILSTERN HEALTH CARE LIMITED: ASX MARKET RELEASE - UNPAID

ANNUAL LISTING Australian Stock Exchange Company Announcements

August 24, 1993

to

contents

Mrs

Millie Phillips

Millie Phillips was clearly a remarkable and

forceful woman. Her efforts deserve our admiration. Left destitute

with two children, she borrowed and then made her fortune in Nickel

before turning to health and hotels.

|

Dec 1986 Mrs

Phillips career

|

From a standing start - a

marriage break-up had left her with two children- she had made her

first million within five years.

Over the years, IMC has had its

ups and downs - mostly downs - with a low point coming when Mrs

Phillips was charged with insider trading. She bought 4,000 shares

a fortnight before the Trough Wells assays were announced, adding

to the 2 million she already held.

The charges were dismissed, but

Mrs Phillips never sold those shares, watching their price plummet

from $10 to 10c. And neither has she sold down her holding or

relinquished her role as chairman of IMC, although the company has

been in and out of gold, nickel, uranium and a variety of other

commodities.

MINER MILLIE EXPANDS IN HEALTH CARE Sydney Morning Herald

December 3, 1986

|

Aug 1991 Australia's

richest woman

|

Millie Phillips, is not on

the BRW list but is often cited as Australia's richest self-made

businesswoman, and possibly the only woman to forge a career in

the largely male-dominated investment sector. Phillips borrowed

from a bank in 1961 to buy a small boarding house in Sydney's

Ashfield. She had just separated from her husband and had three

children to support.

-------------------------

Phillips also runs International Mining Corporation, a gold and

metals exploration company.

Polish-born Phillips, the first

woman to be charged with insider trading in Australia in 1974 (the

charges were later dismissed), is said to be worth over$40

million.

AUSTRALIA'S RICHEST WOMEN Sun Herald August 25,

1991

|

Aug 1999 More about

Phillips

|

After Phillips separated

from her husband in the early 1960s, she took a bank loan to open

a boarding house in Sydney while supporting her two children. She

made her first million within five years. International Mining

Corporation was listed in 1970, on the day that shares in the

nickel mining company Poseidon hit $200. The company was delisted

in 1997; at the time, Phillips was still running it.

-----------------------

In the 1990s, Milstern opened Rose Bay Towers in Sydney, a

block of serviced apartments, and the Ritz Nursing Home at Leura,

New South Wales, plus several retirement villages in New South

Wales and Queensland. As well as her involvement in the mining and

health-care industries, Phillips was the owner of Castle Hotel

Group and chaired the hotel group Flag International.

Where Are They Now? MILLIE PHILLIPS Business Review Weekly

August 13, 1999

to

contents

The Hotel

Businesses

(Not Milstern but the same

owners)

Two of Canberra's largest and most

prestigious hotels were acquired by Mrs Phillips and her son Robert's

other companies. They were also a catering business which provided

catering to the old parliament and to the National Library. The

conflicts, and the ups and downs in the hotel marketplace are

described in the press as are staffing issues. One of the concerns on

these web pages is the consequence for sick or aged citizens when

health and aged care markets experience similar conflicts, ups and

downs, as well as the disruption when they are traded from one owner

to another in the marketplace. What would have happened to aged care

residents had nursing homes been involved in the sort of dispute

described in the press reports in this section?

Of interest is the relationship between

owners/management and staff. Care in health and aged care is heavily

dependent on the dedication and motivation of the staff.

Relationships need to be different to those in the wider marketplace.

Staff also need greater security and continuity. Problems can arise

in the provision of care if management does not share the

humanitarian mission in the same way as their staff.

to

contents

The

Canberra International

Hotel

The Canberra International Hotel opened in

1981. It was acquired by the McGauran family business in 1988. Father

and two son's were prominent conservative National Party politicians.

Peter McGauran has been a minister in the Howard government for some

time. His brother Senator Julian McGauran created some political

flack when he defected from the National party to join John Howard's

liberal party.

The hotel was purchased by Mrs Phillips and

her son Robert when the McGaurin company restructured by going into

receivership. It was turned into 162 strata units. These were sold

independently.

|

Apr 1988 McGauran

family buy hotel

|

The McGauran Group, motel and hotel owner, has paid $16.25

million for the Canberra International Hotel.

-----------------------

The Canberra International, which fronts Northbourne Avenue, was

opened in 1981 and extended in 1984. It has 152 rooms, including

five suites, 36 guest apartments and an inground swimming

pool.

------------------------

A spokesman for the group said that the Canberra International

would be substantially refurbished.

MCGAURAN BUYS CANBERRA INTERNATIONAL Australian Financial

Review April 5, 1988

|

Aug 1988 Politics

and the McGauran family background

|

Peter McGauran is assured of at least one vote in any spill as

his brother Julian is a senator. Young Peter and his brother

Jules, from the Western Districts of Victoria, are reputed to be

the wealthiest men in Parliament.

--------------------------

Peter, Jules and their dad handed over $17 million for the

Canberra International Hotel on the weekend, which may bring in a

few more votes among the waverers.

BLUNT AND SHARP WAIT IN THE WINGS Sydney Morning Herald

August 2, 1988

|

Apr 1993 McGauran

group in receivership

|

The McGauran family's Rathdowne Melbourne and Downtowner hotels

and their Canberra International hotel have gone into

receivership, with the ANZ bank this week appointing an agent as

mortgagee in possession for the hotels.

---------------------------

The outgoing co-manager of the McGauran group of companies and

newly elected National Party senator, Julian McGuaran, said

yesterday that the company had negotiated the receivership with

the ANZ.

-----------------------------

Mr McGauran said the company's decision to restructure had also

been shaped by his return to politics, which would effectively

take him out of the running of the companies and reduce its

management team.

------------------------------

The group will be run by Mr Gauran's father, John McGauran, and

brother, John junior, when Mr McGauran moves to Canberra

soon.

Mr McGauran was a Victorian

National Party senator from 1987 to 1990.

ANZ Steps In At McGauran Hotels In Debt Rejig The Age April

3, 1993

|

Mar 1994 Hotel

bought by Mrs phillip and her son. Strata units sold to

investors

|

The sales of 95 out of 162 strata units in the Canberra

International Hotel at 242 Northbourne Ave brought in about $13.5

million for Sydney hotel investors Mrs Millie and Mr Robert

Phillips.

Their vehicle, Jaywood Pty Ltd,

bought the hotel for about $11 million in May last year. The

remaining units are on the market at between $123,950 and

$219,950.

HOTEL STRATA UNIT SALES TOTAL $13.5M Australian Financial

Review March 24, 1994

to

contents

Canberra Times threatened:- The Canberra Times was threatened

with legal action when they reported on concerns about profitability

and staff cuts. Business Sydney reported that others were doing

better. By 1998 the hotel was reported to be fully booked. Subsequent

developments and a legal dispute suggest that there was substance to

the Canberra Times report. The Australian Financial Review reported

in 2002 that what "is not in dispute is that the units have proved an

ugly investment".

|

Mar 1997 Profit and

staffing problems - Defamation threat

|

The Canberra Rex and the Canberra International Hotel have been

laying off staff because of heavy losses.

The Canberra Times has obtained

documents to this effect and statements from former and current

employees. These indicate that the hotels are ex-periencing

difficulties, though the owner says they are going better than

ever.

The hotels with 156 rooms each

and about 300 permanent and casual employees have been operating

with minimum staff.

A letter from former general

manager Michael Toomey, dated February 19, explains how he was

instructed by the owner, Millie Phillips, to change the Canberra

operations.

"The heavy losses the group have

experienced of late have forced the inevitable streamlining of our

Canberra operations," Mr Toomey told the employees.

"We regret we have no

alternative but to make your position redundant effective

immediately and enclose two weeks' pay in lieu of notice plus

accrued annual leave and the like."

Mr Toomey has since left the

company, which trades in Canberra as Castle Group Canberra. The

Castle Catering Group also provides catering at Old Parliament

House and the National Library.

Mr Toomey has confirmed that

more than 15 employees have been made redundant. Former and

current employees confirm this, and say many more have since

left.

Staff say the hotels are running

without a general manager but are achieving 50 to 80 per cent

occupancy.

The hotels are understood to be

being downgraded from 4-star to 3-star and staff have been told

the difficulties are short-term.

------------------------

Asked about the information from staff, Ms Phillips said hotel

operations were not changing and were going "better than

ever".

"If they are unhappy about

getting redundancies they should work a little harder," she

said.

She referred questions to her

Canberra solicitors, Vandenberg Reid, but the firm did not return

telephone calls. Instead, the solicitors threatened legal

proceedings against The Canberra Times.

The Rex is one of Canberra's

historic hotels and its guests have included former United States

president Lyndon B. Johnson.

Some employees have been told

that death and disability benefits attached to their

superannuation cover are at risk because the company has not paid

January's contributions. Ms Phillips and her lawyers have declined

to comment on this.

A letter from HostPlus

Superannuation Fund to an employee said insurance cover for death

or permanent disability was unavailable if the employer missed

payments, and the employer, Milstern Health Care Ltd (Canberra

Travelodge), had not paid the contribution.

Canberra Hotels In Trouble, Staff Lay-offs Canberra Times

March 19, 1997

|

Apr 1997 Hotel

feeling the decline in bookings

|

Canberra, Australia's Capital, is seeing positive developments in

its tourism and accommodation industry. - - - - Subsequently,

employment in the market has also risen, from 221 staff members to

a remarkable 2,354.

-----------------------

The Canberra International Hotel is one hotel that is feeling the

brunt of a decline in bookings, although in general, its occupancy

rate remains steady.

Three star hotels lead growth in ACT accommodation Business

Sydney April 7, 1997 FROM ABSTRACT by ABIX (Business Intelligence

Australia Pty Ltd)

|

Feb 1998 Now fully

booked

|

Canberra's tourism industry is experiencing its busiest time in

three months with major events in the city forcing some hotels to

turn away guests. - - - - the Canberra International Hotel also

are fully booked.

Boom Time For Hotels Canberra Times February 4,

1998

to

contents

The Strata Title Investors precipitate a dispute:- In 1999 a

crisis was precipitated by the strata title owners who elected to

terminate Millie Phillips company as manager. They claimed

profitability was way below what they expected. They appointed

another manager. Mrs Phillips still owned 42 of the units. She

rejected the majority decision and continued to manage these units

through her company.

As a consequence two hotels were run in the

same premises. A six year very costly court battle followed. At the

end of this the judges

ruled that although the original

brochure had contained "glowing puffery" that should have been

ignored, the financial losses were due to the market and could not be

blamed for this. He indicated that management deficiencies had

contributed to the losses but indicated that the investor's claims

had not been made on this basis.

The court decided in favour of Mrs Phillip's

companies and huge costs were awarded against the investors. The saga

is interesting in what it reveals about marketplace disputes. Had

this been nursing homes or hospitals would these payments have placed

pressure on the funding for patient care? Would management's focus

have been diverted from care to market concerns? Would "glowing

puffery" have been recognised as such by anxious seniors and their

families? Would the law view this in the same way?

|

May 1999 Precipitate

closure when owners installed a new

manager

|

Guests at the 156-room Canberra International Hotel in

Northbourne Avenue, Dickson were shown the door last weekend when

management walked out, leaving no-one to run the hotel and

threatening its short-term future.

---------------------------

The walkout follows a decision by the 109 owners of the rooms at

the Canberra International to replace its management company with

the Premier Hotel Group, which runs the Diplomat.

The changeover has not been

smooth.

----------------------------

The Canberra International was strata-titled in 1993 when

individual rooms were sold to investors at a guaranteed annual

return of up to 10.5 per cent for five years.

-----------------------------

The guarantee period ended last December and unit owners have not

been happy with arrangements since.

-----------------------------

"But we certainly expected to do better under new managers than

was offered by the old management." The owners did everything they

could to ensure a smooth transition from the previous managers to

the new. "We were still negotiating [last] Saturday

night."

Paul Green, of law firm Meyer

Clapham, which represents the former management company and its

principal, Millie Phillips, said the unit owners had not thought

through the changeover arrangements.

"The management was given an

ultimatum to get out by 10am he said.

"They own the business name, the

phone lines, the fax lines and, I think, every stick of furniture

except those in individual rooms. They own the paintings on the

walls."

Mrs Phillips, who also ran the

Canberra Rex, had put a lot of money into painting and maintaining

the hotel. She owned 42 Canberra International units as well as

most of the public spaces, including the reception area, manager's

office, restaurant, dining room, conference rooms and

kitchens.

"She feels she's been harshly

treated," Mr Green said.

These public areas might have to

be sold. "Whoever buys them controls the hotel," he said.

---------------------------

The hotel is expected to reopen on May 24, trading as the Pavilion

on Northbourne.

Management Out, So Guests Told To Leave City Hotel Canberra

Times May 8, 1999

|

Nov 1999 The court

saga commences

|

The 16 investors - whose numbers could soon swell to more than 30

- are suing Filaria Pty Ltd, the company which sold them units,

and the Independent Group, which handled the sales on Filaria's

behalf.

Some of the investors are also

suing individual sales representatives employed by the Independent

Group and the solicitors they, the investors, engaged to handle

purchases on their behalf.

Filaria Pty Ltd is associated

with the owner of the Canberra Rex, Millie Phillips. Mrs Phillips

owns 42 of the Canberra International's units. Another related

company, Jaywood Pty Ltd, which held a lease over the public areas

of the hotel, managed the serviced apartments until May this year

when the 109 unit holders terminated the arrangement.

----------------------------

One (Canberra law firm) has issued a number of notices

under the corporations law asserting that the contracts between

investors and Filaria are voidable because of Filaria's alleged

failure to issue a prospectus when the units first came on the

market. The prospectus issue also figures in the Supreme Court

claims.

-----------------------

The claims lodged with the Supreme Court allege misrepresentation,

misleading and deceptive conduct and false representations on the

part of Filaria, the Independent Group and various sales

representatives.

------------------------

The false or misleading representations allegedly relate to the

use to which units could be put and their long-term investment

potential, among other things.

The investors are seeking

unspecified damages and declarations that their 1993 contracts

with Filaria are void.

Hotel Unit Holders Hone Legal Swords Canberra Times

November 19, 1999

|

Nov 1999 Conflicting

views

|

Wrangling over the once great Canberra International Hotel in

Northbourne Avenue steps up a level this week when 42 of the 156

studio apartments split off to become a separate

motel-within-a-motel.

The owner of the breakaway 42

units and former manager of the Canberra International, Millie

Phillips, is to launch the Budget International Motel offering her

rooms for $55 a night.

The going rate for other rooms

at the hotel is $115.

Now trading as the Pavilion on

Northbourne, the hotel has struggled to attract business as Mrs

Phillips took with her the registered name, phone numbers and

client records, all of which she owned.

------------------------

As the hotel struggles, small investors who depend on the

apartments say they are suffering. Unit owner Iain Blackadder said

he and his fellow investors were "bleeding".

"We have had no income from our

investment since April and some of us are on interest-only

loans."

He said the unit owners spent

more than $100,000 on refurbishments after Mrs Phillips left. "It

was very rundown."

--------------------------

A spokesman for Mrs Phillips, Paul Green, of law firm Meyer

Clapham, said, "When Mrs Phillips ran the hotel, the unit holders

received a return.

"Since she was removed, they

have received no payments.

"Everybody's a loser."

---------------------------

The chief executive officer of the Premier Hotel Group, Peter

Barter, questioned whether Mrs Phillips would be permitted to run

the Budget International Hotel from Studio 101 of the

hotel.

"It's not in the lease purpose

clause," he said.

Mrs Phillips was

unmoved.

"The new managers are there

illegally anyway," she said.

Mrs Phillips claims ownership of

the common areas of the hotel including the restaurant, reception,

office areas and function rooms.

"They haven't paid for its use

yet." Many of the unhappy unit owners have launched legal

action.

They claim they would not have

invested in the units had they known how it would all turn

out.

Hotel's Woes Continue As Ex-manager Opens Motel Canberra

Times November 28, 1999

|

Mar 2002 A small win

for the investors

|

The long-running dispute between the owner of the former Canberra

International Hotel and investors in what is now the Pavilion on

Northbourne has seen the ACT Supreme Court refuse to place the

latter in the hands of an administrator to end a two-year impasse.

The dispute between Millie Phillips's company, Filaria Pty Ltd,

and the large number of owners of units at the Pavilion has led to

the bizarre situation of having two unrelated and rival hotels

operating in the one building.

--------------------

The upshot was that Filaria began operating the Budget

International Hotel, while Premier managed the Pavilion on

Northbourne, both from the same premises.

------------------------

Claiming the arrangement was intolerable and that the original

concept of the Canberra International Hotel had been destroyed,

Filaria instituted proceedings seeking the appointment of an

administrator of the body corporate representing the investors,

which the investors resisted. Chief Justice Miles said the present

situation was essentially of Filaria's making. Neither the

investors nor the body corporate had asked for Budget

International to be established.

Hotels in bizarre legal impasse Canberra Times March 11,

2002

|

Jul 2002 The dispute

and its implications

|

Ms Phillips is embroiled in what could be the largest and most

complex series of cases yet heard in the ACT as many of the owners

of units in the Pavilion on Northbourne Hotel & Serviced

Apartments battle to recover their investments.

The cases could have dramatic

implications for the broader real estate industry, for they pose

the question of whether developers, agents or owners should be

liable for misrepresentation if a property which is described

simply as a "good investment" ultimately proves

otherwise.

Fifty-nine of the investors have

actions against one of Ms Phillips's companies, alleging

misrepresentation over how their units could be used and over how

profitable they would be.

-------------------------

At the same time, a smaller group of investors in the hotel have

launched their own action arguing that because no prospectus was

provided at the time they bought their units, the sales breached

Corporations Law.

(Today such a scheme would

unquestionably require a prospectus but these units were bought

before the introduction of the Managed Investments

Act.)

All the defendants deny the

allegations. What is not in dispute is that the units have proved

an ugly investment.

-----------------------

But when the guarantee expired the trouble started. At a memorable

meeting, Ms Phillips told investors that the Canberra hotel market

was in the doldrums and, with new competitors coming into the

market, she could no longer meet their expectations. The investors

revolted and terminated the management agreement.

Most signed new agreements with

a new operator; some elected to manage their own. Ms Phillips, who

owns 42 units in the building as well as the nearby Rex Hotel,

went her own way.

----------------------

First the hotel closed altogether. And since reopening, it has

been plagued by disputes between the investors and Ms Phillips

over basic hotel necessities, such as the telephone system, the

restaurant, the office and the function rooms.

----------------------

Worse, Ms Phillips is undercutting the investors by offering her

rooms at a base $55 a night.

For investors, the results have

been disastrous. One owner, who had been banking $1,000 a month in

income is now receiving just $320. Sure, they earned big incomes

while the guarantee was in place but many, who financed the

properties up to the hilt, are today battling to fund the

mortgage.

Another investor, a former

school teacher in his late 70s, has gone back to work to maintain

the units that were supposed to maintain his

retirement.

Values have been savaged. One

investor believes her unit - for which she paid $123,000 - might

now be worth $60,000.

---------------------------

"This case is chewing up huge legal resources and potentially very

high costs millions of dollars to the loser," said Ms Phillips'

solicitor, Myer Clapham managing partner Paul Green.

Property - Hotel row evolves into legal saga. Australian

Financial Review July 13, 2002

|

Nov 2003 A win for

Mrs Phillips

|

In October, the investors failed to convince the court that the

transactions they had entered into should be set aside because of

breaches of Corporations Law provisions designed to protect

investors from dubious investment schemes. The ACT Court of Appeal

dismissed last week their appeal against the October ruling.

However, the investors' claims of misrepresentation and misleading

and deceptive conduct remain alive and have been the subject of a

lengthy but unresolved Supreme Court hearing this month. The

investors were ordered by the Court of Appeal to pay the costs of

Filaria and Jaywood.

Court dismisses appeal by apartment investors Canberra

Times November 1, 2003

|

Jun 2004 An

expensive defeat for investors - Judges conclusions and

criticisms

|

A large number of investors in a serviced- apartment project in

north Canberra have suffered a second expensive defeat in the ACT

Supreme Court in their bid to recover their losses from the

developer and a real-estate agency. The court has dismissed claims

by four investors that they were the victims of misrepresentation

and false and misleading by Filaria Pty Ltd, a company associated

with developer Millie Phillips, and the Independent Group Pty Ltd.

Several months ago the ACT Court of Appeal dismissed claims by 11

investors that their transactions should be set aside because of

breaches of Corporations Law provisions designed to protect

investors.

---------------------

Justice Crispin said it was understandable that investors were

acutely disappointed at the poor returns on their investment.

However, their losses - which occurred in and after 1999 - were

not attributable to misrepresentation or false or misleading

conduct in 1993 or at all.

Allegations that rents had been

set at unsustainably high levels and that profit projections had

been unrealistic and wrong had not been established. ''The losses

which the plaintiffs have sustained seem to have occurred

substantially because of management decisions taken in 1999 and a

failure to provide the necessary funds to adequately maintain the

hotel,'' the judge said. ''The events of 1999 seem to have left

the plaintiffs with considerable resentment against Ms Phillips

but no cause of action based upon those events was pleaded.''

Instead, the plaintiffs had sought to disclaim responsibility for

both the decision to purchase the units in the first place, and

for management and maintenance decisions, and to attribute their

losses in 1999 ''to some fault on the part of one or other of the

defendants in 1993''. ''No adequate basis for these contentions

has been demonstrated.''

Case lost against units developer Canberra Times June 16,

2004

|

Dec 2004 Punitive

costs awarded against investors

|

Four of the 60 investors in a serviced apartment project in

Braddon have been hit with a crushing costs order over their

failed litigation against developer Millie Phillips and a

real-estate agency, the Independent Group.

The four investors and their

lawyers, Gillespie-Jones & Co, were criticised yesterday by

the ACT Supreme Court for unreasonably refusing to negotiate a

settlement of claims the lawyers should have known were at best

tenuous.

---------------------------

An indemnity costs order is punitive in nature and is the highest

the court can make. The four plaintiffs will have to pay something

approaching the full legal costs incurred by their opponents since

May last year, including those of a 28-day hearing in the Supreme

Court. Hundreds of thousands of dollars are likely to be

involved.

-----------------------------

In May 2003, Filaria offered to settle all claims against it by

buying out each investor for $60,000 and paying everyone's legal

costs. The offer was rejected.

----------------------------

A second offer to settle, a few days after the hearing began, was

also rejected.

Investors to pay hundreds of thousands, judge rules

Canberra Times December 18, 2004

|

May 2005 Investors

lose on appeal

|

Investors in a serviced apartment project in Braddon may be

facing a legal bill of more than $4million as a result of

unsuccessfully taking their case to the ACT Court of

Appeal.

Canberra businesswoman Millie

Phillips, one of the successful defendants, said the case should

never have gone to court.

Her company had paid its lawyers

$1.3 million. A substantial proportion of this might now be

recoverable from the investors. She estimated the investors' own

legal costs to be about $3.6million. ''The only worthwhile aspect

were the legal fees,'' she said.

---------------------------

The Court of Appeal has now dismissed an investors' appeal against

Justice Crispin's legal rulings. It is yet to decide whether his

costs orders were justified.

---------------------------

The court said that an investment report prepared on behalf of the

defendants, in which various assertions on profitability were

made, had ''clearly contained glowing puffery that was

appropriately to be ignored''. However, the investors' losses were

the result of a depressed market and a falling out with Filaria,

not what was contained in the brochure.

Project's investors facing $4m legal bill Canberra Times

May 28, 2005

|

Aug 2005 Costs for

investors reduced by appeal court

|

Investors in a Canberra serviced apartment project have rescued

something from disastrous litigation against a developer and a

real-estate agency, but only to the extent that their losses are

not as bad as they might have been.

---------------------

But the ACT Court of Appeal has now overturned the judge's ruling.

The three judges said that while the settlement negotiations had

been confused and ''a mess'', they had been continuing.

The court's order means the

plaintiffs must still pay the defendants' costs, but not at the

close to full-cost recovery level previously ordered.

Court ruling eases 'crushing' losses for Pavilion investors

Canberra Times August 11, 2005

to

contents

The Rex

Hotel

The Rex hotel was not involved in similar

controversy. When it was time to pull it down and rebuild, it was

decided to redevelop the site for apartment blocks. The project

elicited some environmental objections and an outcry about asbestos.

A compromise was reached. Then it was bought by someone else, refurbished and

expanded.

|

Dec 2002 The story

of the Rex Hotel

|

The Rex was built in 1960 at a site that looked out over empty

paddocks and was the first significant building for visitors

driving in to the national capital along Northbourne Avenue. Its

guests have included United States president Lyndon B. Johnson,

Prince Charles and many of the world's best-known leaders,

personalities and entertainers, including Shirley Bassey, Sir

Robert Helpmann, David Frost, Dame Margot Fonteyn, James Mason and

The Seekers.

Canberra Rex enjoys its final festive feast Canberra Times

December 26, 2002

|

Dec 1988 Bought by

Mrs Phillips company

|

One of Canberra's best-known hotels, the Canberra Rex, sold last

week for$12.75 million to Rebenta Pty Ltd, a company associated

with Mrs Millie Phillips, the founder of the Milstern Group of

companies.

REBENTA IN $12M CANBERRA REX BUY Australian Financial

Review December 29, 1988

|

Mar 2002 Plan to

build apartments - objections

|

A $40 million plan to redevelop the historic Canberra Rex hotel

into a nine-storey 287-apartment complex has been unveiled for

public comment.

---------------------

Proposed by Sydney developer Millie Phillips, the one-and

two-bedroom apartments would be sold as long-term residences, not

serviced apartments, at prices between $180,000 and $240,000.

------------------------

The plan for the Rex requires Mrs Phillips to surrender her Crown

lease over the Braddon hotel site and apply for a regrant. The

hotel would be demolished.

------------------------

The Braddon representative on the Local Area Planning Advisory

Committee, Peter Conway, has objected to the proposal on heritage,

traffic and occupational-safety grounds.

-------------------------

But he said the major concern was the possibility that the

42-year-old building contained asbestos and he called for

certification from Commonwealth and ACT safety authorities that

the site was asbestos-free. - - - - - - - - The hotel was fined

$5000 in the ACT Magistrates Court in 1997 for exposing employees

to asbestos.

$40m redevelopment plan for Canberra Rex unveiled. Canberra

Times March 20, 2002

|

Apr 2002 Development

application

|

Hotel owner Rebenta Pty Ltd has submitted a development

application to Canberra City Council seeking to demolish the Rex

and construct 287 residential apartments.

----------------------

The Rex is located on a prime three hectare site on 150

Northbourne Avenue at Braddon in the heart of Canberra's

CBD.

Rebenta, which is lead by

national hotel owner Mrs Millie Phillips, bought the 31/2 star

hotel in December 1988 for $12.75 million. The property previously

traded for $2.395 million in 1983.

--------------------------

The Rex was built in 1964 and at six-storeys, was one of the

earlier multistorey buildings in Canberra.

It became famous as a stopover

for visiting dignitaries, including the then United States

President Mr Lyndon Johnson during his visit to Australia in

1966.

Flats For Canberra Rex Site Australian Financial Review

April 9, 2002

Turner Residents' Association president Mac Dickins said he

feared the proposed 287-unit development would add to Northbourne

Avenue becoming a "canyon of buildings". "It's going to be a very

big, massive building, and there's very little open space. It's

nearly all hard surface, and at the front the set-back is lacking

in soft landscaping," Dr Dickins said. "It is out of character

with the garden nature of the city and local people are very

concerned about the build-up of traffic in the area."

Braddon Residents' Association

acting chairman David Gordon said plans presented to the

Inner-North Local Area Planning Advisory Committee last September

by the developers had been largely acceptable, but the ones

proposed now were very different. "The development is

significantly more massive and covers the site to a much greater

degree," Mr Gordon said. "The number of units is grossly

excessive."

Neither the developer, Millie

Phillips, nor architect Tom Kean were available to comment.

However, Rex Hotel general manager Don Yourell reiterated that Mrs

Phillips had not yet decided to proceed with the project and was

first seeking development approval.

Locals baulk at Rex Hotel development Canberra Times June

2, 2002

|

Sep 2002 Compromises

and approval - to be demolished

|

The Rex Hotel on Northbourne Avenue will be demolished early next

year to allow for the construction of a 267-apartment complex, due

to be completed by the end of 2004. Rex owner Millie Phillips said

yesterday the hotel, built in 1960, would be demolished 'as soon

as possible'. Approval for the development to proceed was granted

by Planning and Land Management on August 28. The building will

close early in 2003 and residual asbestos will be removed before

the demolition work begins.

-------------------------

- - - - the number of proposed apartments has been reduced to 267.

Architect Tom Kean said the change was made to allow for more open

space within the complex and the retention of some existing trees.

The redesign was prompted by inner-north residents groups who had

concerns about the original proposal.

Rex demolition to begin next year. Canberra Times September

7, 2002

|

Nov 2007 The

Rex sold, refurbished

and enlarged - Not demolished

|

Local icon the Canberra Rex Hotel is to double in size with a nine-storey

addition costing up to $40million to be built on its site in Braddon. The

development will see the Rex increase from 156 rooms to just over 300.

Rex Hotel general manager Ray Palmer quashed suggestions from a caller

on local radio yesterday that the 1960 Northbourne Avenue building was

to be demolished.

-----------------------

The former owner of the Rex, Sydney businesswoman Millie Phillips, proposed

in 2002 to demolish the original building to make way for a nine-storey,

287-apartment development estimated to be worth $40million.

Development to see Rex rise and shine Canberra

Times November 22, 2007

Favouratism but not for Mrs Phillips:- During this period there

were allegations of favourable treatment of Milstern nursing homes

because of political donations and ministerial support. There was no

sign of this with the Rex. Mrs Phillips was critical when a minister

stepped in to fasttrack another operator's project and overrule her

objection to this nearby development.

|

Dec 2002 Government

steps in to helps competitor.

|

The western area of Civic received a long-awaited boost yesterday

with the ACT Government's announcement that the $140 million

residential development on Section 6 had been given the go-ahead.

Planning Minister Simon Corbell used his call-in powers to

short-circuit objections to the development, saying further delays

would not be consistent with community benefits.

-------------------------

The project hit a sour note with developer Millie Phillips, who

wondered why the trees on the Metropolitan site were worth less

than the 'six scungy conifers' which had cost her 16 apartments at

the 260-unit Rex Hotel development on Northbourne Avenue. 'In the

end I sacrificed the units there because I did not want to put in

another application and waste two more years,' she said yesterday.

'But I really would like to know why the minister can wave his

magic wand for this development but not for mine.'

City West $140m plan gets go-ahead Canberra Times December

20, 2002

to

contents

Equal

Opportunity Issues

Allegations about breeches of the equal

opportunities regulations in 2001 elicited an angry response by

almost all those who were named. It seems that the regulations

required excessively onerous documentation and these companies had

refused to fill in the forms. Mrs Phillips who employed large numbers

of women was outspoken.

|

Nov 2001 Mrs

Phillips refuses to fill in forms

|

They are among 29 companies in the retail, transport,

manufacturing and food and beverage sectors named in the annual

report of the Equal Opportunity for Women in the Workplace

Agency.

---------------------------

"Those companies named for non-compliance will have to suffer the

stigma of public exposure and the scrutiny of prospective

employees who may regard them as being adversarial to women and

equal opportunity," Ms Krautil said.

Managing director of one

recalcitrant company, Millie Phillips of Milstern Health Care in

NSW, said she did not have time to fill in the agency's forms. "It

is not appropriate for a company such as mine to have to spend

hours and hours and hours of filling in those forms. I've never

done it," she said.

"I'm a self-made businesswoman,

all my chiefs are women and 95 per cent of my staff is women. If

anyone has a complaint, it's men in my organisation ... how much

more womanised can I be? "I have told them every year, `I refuse,

do whatever you want, name me, shame me' ."

Equal rights file shames firms Courier Mail November 1,

2001

Milstern Health Care, which operates the notorious Yagoona

Nursing Home, is among 29 Australian companies named by the Equal

Opportunity for Women in the Workplace Agency for its failure to

obey the law.

------------------------------

Milstern Health Care employs about 800 people around NSW and runs

Yagoona, Leura and The Ritz nursing homes.

-----------------------------

The Act requires companies to report on programs and strategies

aimed at employing women and improving opportunities in the

workplace for women.

Home in breach of equal jobs Sunday Telegraph November 4,

2001

|

Nov 2001 Others

support Mrs Phillip in her objections

|

ORGANISATIONS named in a government equal opportunity "shame

file" have hit back, claiming they have been unfairly targeted

simply because they refused to complete mountains of

paperwork.

--------------------

Four of the five Queensland organisations named said they had

active equal opportunity programs but did not have the time to

return the paperwork demanded each year.

Shame on YOU - Companies hit back over `outing' in equal

opportunity report. Sunday Mail November 11, 2001

|

Oct 2002 A repeat

"offender"

|

The Equal Opportunity for Women in the Workplace Agency announced

details of 28 companies in breach of equal opportunity

legislation.

Agency director Fiona Krautil

said the number of companies ignoring the needs and rights of

women were declining, but many were repeat offenders.

---------------------------

In NSW, 13 companies had failed to comply with federal Equal

Opportunity legislation. They are: - - - - - - - - Milstern Health

Care Limited [Sydney]; - - - - .

Women take on bosses over rights Daily Telegraph October

29, 2002

to

contents

Retirement

Villages

Milstern has been active in the Retirement

Village marketplace. This sector suffered during the late 1988

economic downturn and investors were slow to return to it.

|

Sep 1993 Retirement

villages

|

The chairman of Milstern Health Care, Mrs

Millie Phillips, said

she had developed four retirement villages, the newest being

Windsor Gardens at Chatswood.

----------------------------

"The reluctance to lend to industries such as ours follows the

badly considered loans made by banks during the excesses of the

'80s," Mrs Phillips said.

LENDERS SHUT VILLAGE GATES Sydney Morning Herald September

25, 1993

|

Mar 1996 Owns nine

villages

|

Windsor Gardens in Mowbray Road, Chatswood

is Milstern's newest

retirement village. Milstern has a chain of nine villages,

providing all levels of care.

Villages Can Improve Quality Of Life For The Elderly Sydney

Morning Herald March 16, 1996

STOP

PRESS

Urimbirra

Village - "The

worst village" (Rewritten and

updated Jan 2009)

Residents who have purchased retirement units from one

owner whom they have researched and believe will care for them responsibly

in their declining years may find themselves and their services sold off

to an owner who behaves very differently. This can have an enormous impact

on their lives and on the quality of their final years. This is

simply another

situation where the market fails in aged care.

The Urimbirra Village in Hervey

Bay (Queenssland) was referred to as "The Worst Village" in a

2004 report from the Association

of Residents of Queensland Retirement Villages.

What happened there illustrates just how powerless residents are

in

the marketplace, and the consequences of aggressive commercialism

for residents.

A bitter dispute between Milstern and the residents

at Urimbirra Village has dragged on for 15 years. During this time their

numbers

steadily dwindled as the new owner, whom residents claim wished

to redevelop

the increasingly valuable property, bought out units as they were vacated

and

induced other

residents to sell. Residents claim they were put under pressure to sell

for a

fraction of their unit's

real

value

and

for

much less than they had originally paid.

A nucleus of thirteen

80 and 90 year olds held out and battled on alone, receiving very little

assistance from the bodies set up to protect their interests. It was only

in December 2008 that a decision in their favour was made by the Commercial

and Consumer Tribunal (CCT)vindicating their position. The

tribunals findings

were damning of Milstern and Ms Phillips, but they do not require Milstern

to

either continue operating the facility or to pay a fair

price for

these units, let alone one which compensates them for the disruption in

their planned retirement - so the battle continues.

The story

Milstern purchased the Urimbirra retirement village in

a bulk deal as part of a package of mostly NSW facilities in

1994. The residents

were soon in dispute with the new owner. There was correspondence

with

the office of fair trading about

Milstern's conduct as early as 1998.

Residents claim

that Ms Phillips did not want the facility, claimed she

could not make

a profit

from it, took little interest in it, and that she has blamed the

residents for problems there. Residents claimed that the property was not

well maintained,

was

allowed to deteriorate, there was little if any

consultation with residents,

few

replies to correspondence, and that little effort was made to sell

empty

units. Property in the area was booming. The residents

believe she wanted

to get them out and redevelop the site to make more money

from it.

Relationships deteriorated further in 2000

when Milstern

sent residents a demand that they pay an extra $90 a month. Some paid but

others refused because of inadequate financial documentation for

this charge

and because of unresolved tax issues relating to the payment of GST. The

residents

had difficulty in getting these matters to the tribunal because of legal

jurisdictional difficulties resulting from a recent change in the

act.

Newsletter

number 49 of December 2004 from the The Association of Residents

of Queensland Retirement Villages had a section near the bottom of the

page headed "The Worst Village". This described the concerns

the association

had about the way in which Milstern dealt with units at Urimbirra village

when the residents departed, and also residents complaints

about management.

They believed Milstern was in breach of the conditions under

which the

village was registered as a retirement village and was unlawfully defying the

Retirement Villages Act. Authorities took no action.

The residents were also concerned about the

retrospective

removal of a large sum from the sinking fund. Even though there was still

money in the sinking fund a levy was then raised from the residents to pay

for a new call system else this would have been refused by Milstern. The

residents felt that Milstern advertised this in its brochures and should

have paid

for it.

They gave in because of its urgency for many elderly residents.

The Office of Fair trading was approached in 2001

and again in 2003 about Milstern's accounting practices, but despite many

promises,

the residents were disappointed by their inaction.

The residents were dissatisfied

with Milstern's accounting practices and believed they were a breach of

the act. There were a multitude of financial and accounting matters they

took

issue with. They believed that Milstern was not disclosing accounts to

them that they were

required

to disclose.

Residents refused to approve the villages accounts because they

felt Milstern

supplied insufficient detail. There were disputes about what

Milstern rather

than residents

should be paying for.

Milstern increased general services charges

by 7% when

the regulations specified that they could not be increased above

the CPI (2.6%) without the approval of residents. The residents had not agreed

to this and had not approved the budget. The budget they claimed

gave insufficient

information and did not conform with the act. They maintained their stance

even when

Milstern claimed that the company might have to be wound up.

Urimbirra

staff dismissed (Added July

2010)

There is an interesting

snippet available on the web. It seems that in response

to a complaint by the residents, an inspector from the Department

of Fair Trading

attended the village. Mr Crossland, the manager signed consent forms to allow

him on site and also provided confidential documents to him. He

failed to notify

Milstern and did not seek their authority. He was promptly

dismissed by Milstern,

and at the same time his de facto who also worked at the complex

was also fired.

The matter came to the

Queensland Industrial Relations Commission in February 2004. They

found that

there were grounds for dismissing Mr Crossland as he had not told his

employer about this. The commission found that the de facto had

been dismissed

on the grounds of marital status only and awarded damages of $9000, almost

the maximum allowable.

The 2005/6 Tribunal Decision

Milstern applied to the Commercial and Consumer

Tribunal (CCT) in 2005 asking them to approve the budget which the residents

had rejected. In rejecting Milstern's application on 11 December 2006 the

tribunal was

critical

of Milstern's management and its breaches of the act. It

expressed concerns

that the manager of the home had made an implied

threat to get residents to do what Milstern wanted. They were concerned about

future "detriment

to residents at the hands of the applicant as a result of their

action in rejecting

the budget and defending this application".

CLICK

HERE to download the 2006 tribunals

findings

|

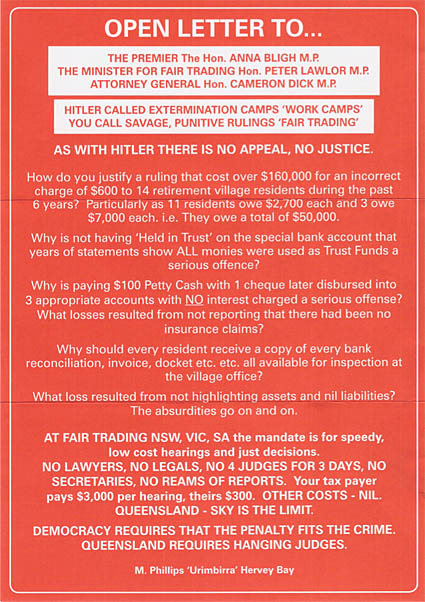

Dec 2006 CCT

rejects Milstern's application

|

1: - - - - - - - - The order sought is that

the budget for the village for the 2005/2006 financial year

which has been

presented

to residents of

the village, but not passed by them, be approved by the Tribunal. John W

Sheppard and Vince Royce (“the first and second respondents”)

are co-spokespersons for the residents and they seek orders that

the application

be dismissed on the basis that the proposed budget for 2005/2006

is in contravention

of the Act.

------------------------------------------

7: - - - - - - It is clear upon an examination of the material

before the Tribunal

that both the budget and account keeping records do not comply with

the Act. The figures in the proposed budget show that the applicant

has increased general service charges by seven percent. This figure is above

the CPI figure and therefore is non- compliant with the Act. There

is provision

for the increase to be approved by the residents, however this would require

the increase to be approved by special resolution and no special resolution

meeting has been called.

------------------------------------------

14: The Tribunal is satisfied that the proposed budget for

2005/2006 has not

been prepared in accordance with section 106(2) of the Act

as it stood

in 2005, and that there has also been non-compliance with section 97

of the Act in the way in which

the maintenance reserve fund is dealt with in the budget. The

Tribunal is unable

to approve the budget in its present form and the application must

be dismissed.

The budget must be reworked and presented again to the residents in a form

which complies with the Act.

---------------------------------------

15 The applicant has demonstrated lack of care and responsibility in

constructing the budget. Mr Garven appears to have adopted

the attitude

that it was the responsibility of the residents to advise the applicant if

the budget was in contravention of the Act, rather than the

applicant accepting

its clear obligation to prepare a budget which complied with the

Act. Mr

Garven has made an implied threat that retribution may be

exacted on

the residents of the village for their refusal to pass the budget.

He has said

that as a result of the residents’ action the management company may

have to be wound up. We are concerned about the potential

for detriment

to residents at the hands of the applicant as a result of their

action in rejecting

the budget and defending this application.

The applicant must address the legitimate concerns raised by the residents.

The delay in having the 2005/2006 budget passed is in no way the fault of the

residents, but is

the result of the applicant’s unacceptable conduct in

preparing a budget which

does not comply with the Act.

Commercial and Consumer Tribunal

: Application No:VH012-05 Delivered at Brisbane December

11, 2006

|

Dec 2008 Summary of 2006 CCT

finding by 2nd 2008 CCT hearing

|

53 It must be noted that

the Tribunal refused to approve the proposed budget for the village for

2005/2006 in an application brought by the respondent in

2005. The Tribunal

found that the budget was in contravention of sections 97 and

106 of the

Act.

Commercial and Consumer Tribunal :

Decision/VH009-07 December

18, 2008

Costs were awarded against Milstern

but it took some time to pay them. No action was taken against Milstern,

by authorities, for

breaching the act. Milstern ignored the criticism of its

accounting practices

and the residents continued to reject the budgets.

(Added July

2010) They

sought help from their local MLA, Tim Nichols and a reporter from the local

paper. The Association

of Residents of Queensland Retirement Villages reported

in April 2007 that according to the chronicle reporter village manager

Jim Garven verbally abused her and ordered them off the property. When the

MLA

refused to leave Garven threatened to call the police.

The December 2008 Tribunal Hearing

The residents applied to the tribunal seeking orders

requiring Milstern to prepare its accounts in accordance with the act and

to pay them additional GST refunds they believed Milstern still owed.

This was followed by almost 2 years of fruitless tribunal

required mediation

before

the tribunal

finally took

evidence.

Milstern meanwhile

attempted

to force the acceptance of the accounts

by threatening

to use the votes of the majority

number of units they owned

if the residents

did not approve the accounts. Milstern was not a resident and not entitled

to vote and the residents refused

to

back

down to this threat. Ms Phillips response to a press report about what was

happening was typically aggressive.

|

June 2008 Still a

bitter dispute.

|

THE owner of a Hervey Bay

retirement village

has been accused of offering one of its unit owners, who is

sick and infirm,

less than half what government-approved valuers say her

property is worth.

-------------------------

Four cases involving Urimbirra Village, relating to service and maintenance

fees and alleged failures by Milstern to provide accounting

records, are before

the Commercial and Consumer Tribunal.

Urimbirra residents claim

Milstern has bought

back the leases of at least 30 of the 49 units in the

complex. Some believe

Milstern may want to buy all the leases so the site can be

redeveloped.

But Milstern's owner, Millie Phillips, said

some residents had affected the village's reputation through

complaints to

the State Office of Fair Trading and Minister for Justice

Kerry Shine.

``There is a mile of documents of

complaints

and the complaints have no basis and now no one wants to buy

there. They

are like the animal that eats its own entrails and now they

want me to come

in and buy their places from them. I'm not obligated to look

after their

financial affairs,'' Ms Phillips said.

The property of a 98-year-old

dementia patient

is at the centre of one dispute with Milstern. Eunice Holland

and her late

husband James bought a 99-year lease in Urimbirra village in

1993 for $76,000.

------------------------

Although property values in the area have soared, Milstern offered $55,000